.png)

Explainer Series: The Process of Signing a Deal

The EIC Fund is Europe's flagship blended funding programme, combining EC innovation grants with equity investments from private investors (typically VCs). The biggest programme of this kind in Europe with a substantial multi-annual investment budget. There is, however, a significant gap between its promise and current delivery.

This is our series of Explainers, aiming to clarify key aspects of this programme: The Process of Signing a Deal.

What is the Process of Signing a Deal with the EIC Fund?

What is the process of signing a deal?

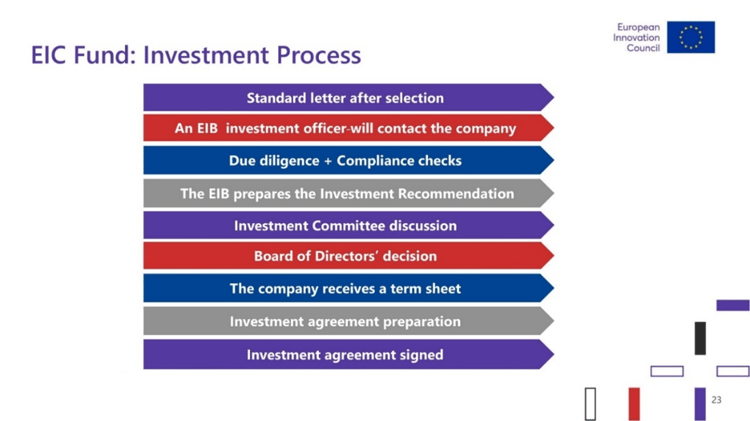

Overview: The EIC Fund investment process consists of 9 steps. Steps 1-3 involve standard communications between the award recipient and the EIC Fund as well as due diligence and compliance checks. In steps 4-6, the European Investment Bank (EIB) prepares the investment recommendation for the investment committee and Board of Directors to review. Finally, in steps 7-9, the company receives a term sheet and the investment agreement is signed.

The EIC Fund was launched under the pilot phase of the EIC to invest in the 159 companies selected under the EIC pilot Accelerator. As of December 2022, only 86 deals have been signed. The accelerator has been hit by multiple delays and most firms are yet to receive funding. In September 2022, the EIC announced the appointment of a new external fund manager.

Step 1

Proposals selected by the EC and awarded an investment component are channeled to the EIC Fund for an initial assessment. The EIC Fund will start the negotiation process to structure the potential investment agreement (compliance checks, 58 due diligence, syndication of potential co-investors, tranches of investment and related objectives and milestones, etc.). Following this initial assessment, the cases will be categorized in accordance with the various possible investment scenarios (“buckets”).

Bucket 0: No Go

- Due diligence reports substantial negative issues (fraud, misrepresentation, failure to submit requested information, material adverse changes).

- Where no remedies are possible, the EIC Fund Board will recommend the EC to reject the investment.

Bucket 1: low maturity and failure to attract co-investment

- Cases that are not sufficiently mature for regular investors, due to remaining very high risk despite the awarded EIC Accelerator support.

Two situations:

(1) Essential area of EU interest*, or addressing a societal need or an EU priority, in particular in the case of strategic technologies. (*EC acquires a blocking minority). The Fund will proceed with the investment alone.

- First tranche can be a convertible note

- Second tranche will generally be an equity round

- Support measures to address shortcomings to a sufficiently high degree

- Board Member seat in the target companies

- External mentoring will be sought

Bucket 2: Co-investment opportunities

- Potential investors show immediate interest in co-investing into EIC selected companies.

- The EIC Fund investment is at least matched by these other investors (i.e., which will cover at least 50% of the round), generally relying on financial, commercial and technology due-diligence performed by them and generally seeking to align to their terms.

- Where the awarded EIC support is conditioned to the acquisition of a blocking minority by the EIC Fund, and in order to align interests, the EIC Fund Board may opt to substitute direct blocking minority by a shareholder agreement providing for similar guarantees regarding EU interests.

Bucket 3: Alternate investment opportunities

- Potential investors show immediate interest in providing the full investment.

- Possibility to co-invest, in particular to secure a blocking minority where the EU interests cannot be otherwise protected or in the case of strategic technologies.

- The EIC Fund may also reserve the initially awarded investment as a possible follow-on investment.

Step 2

The EIB, in its role of Investment Advisor, will undertake financial due diligence (unless performed by co-investors, please refer to Investment Scenarios section under section 3.3). In parallel, KYC-compliance checks will be performed on the target companies.

Step 3

The EIB, in its role of Investment Advisor, will discuss potential draft financing terms with the beneficiary and co-investors (if any), or advise the company in case of alternate investors. The EIC Fund will examine the due diligence together with the structuring proposal from the EIB.

Step 4

The EIC Fund will decide on financing operations.

Step 5

Within the maximum budget awarded by the Commission, the terms of investment will be negotiated on a case-by-case basis by the EIC Fund. The EIC Fund will either approve (sometimes with conditions), including the amount and terms, or reject the operation.

Step 6

Provided that the EIC Fund has approved the investment, the EIB, in its role of Investment Advisor, will guide the work of the lawyers for each specific transaction leading to legal documents, which will be signed by the EIC Fund.

Investments will not exceed 25% of the voting shares of the company (except where for strategic reasons the Commission subjects its support to the acquisition of a blocking minority). Investments will normally be made with a long average perspective (7-10 years) with a maximum of 15 years (‘patient capital’).

Step 7

The EIC Fund will do the monitoring, milestone disbursements, reporting and exit.

- Monitoring and acting on milestone funding, financing events (conversions, top-ups, etc.), write-downs and restructurings, exits, etc.

- Roles such as representative or observer on boards of investee companies - qualified EIC Fund representatives appointed for this purpose (discussed during the due diligence.

- Possibility of follow-on investments on an ad hoc basis to operations that were initially awarded an investment component or a “grant first” support, subject to review by independent experts and advice of the EIC Board.

Disclaimer: Following the appointment of Alter Domus as the new external fund manager, the EIB's role and activities may have changed. Further information on the EIB's role can be found in the EIC Fund's Investment Guidelines document.

Resources

- EIC: https://eic.ec.europa.eu/index_en?pg=investing

- EIC Fund Investment Guidelines: https://eic.ec.europa.eu/system/files/2022-03/220301%20EIC%20Investment%20Guidelines%20-%20Horizon%20Europe%20March%202022%20FINAL.pdf

- EIC Work Programme 2023: https://landing.winnovart.com/eic-work-programme-2023

- EIC Accelerator Status Update: https://eic.ec.europa.eu/news/eic-accelerator-implementation-update-2022-08-05_en

At Winnovart, it is part of our mission to bridge the gap between stakeholders of the grants-funding market-space across Europe. We believe in the potential of grants to create ecosystems that drive innovation, growth and reduce disparities between the regions of Europe. Our aim is to support innovative SMEs, private investors and funding agencies to become part of this ecosystem and make the most of it.

Our presence in Western, Eastern and Northern Europe enables us to create international business cases for our clients, in the context of attractive funding programmes as well as beyond it, by opening up international development opportunities.

For more updates on funding opportunities, please follow us on social media: Facebook, Linkedin or Twitter.

|

For more details about Winnovart please check our website. If you would like to be contacted by our experts please reply to

office@winnovart.com or contact us here and we will get in touch very soon.

|