.png)

Explainer Series: Convertible Note

The EIC Fund is Europe's flagship blended funding programme, combining EC innovation grants with equity investments from private investors (typically VCs). The biggest programme of this kind in Europe with a substantial multi-annual investment budget. There is, however, a significant gap between its promise and current delivery.

This is our series of Explainers, aiming to clarify key aspects of this programme: The Convertible Note.

How does the Convertible Note Work?

What is a convertible instrument?

A convertible instrument is a debt instrument but it has a convertibility feature attached to it. This makes it attractive to the issuing company, since they are aimed to postpone dilution until the company’s next equity funding round. They offer flexibility to investors allowing them to shift the risks and rewards of their investment to some point after the initial investment.

How do they work in the EIC Fund's blended finance programme?

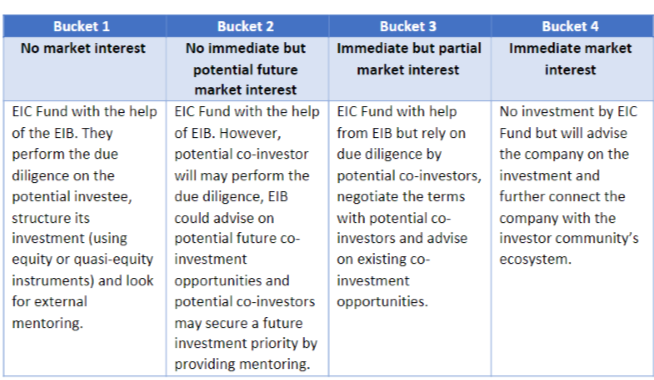

Following the initial assessment, beneficiaries are categorised according to various possible investment scenarios or 'buckets':

Convertible instruments are offered when beneficiaries are labelled as a 'bucket 1' case. This means that the beneficiaries are not ready for private investment because they remain high risk despite being awarded the EIC Fund grant. This instrument is provided in stages from Seed to Growth (Series A, B and C) and aims to help the beneficiary to evolve and scale up.

Within the 'bucket 1' case, two tranches will occur:

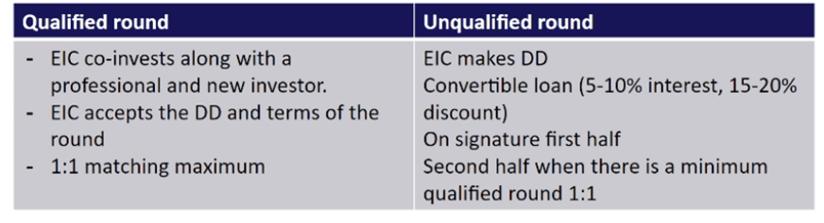

In first tranche, the EIC Fund will invest, upon signature, the maximum of either 50% of the estimated EIC Fund investment or the unfunded cash needs of the company over a period of generally up to 18 months in the form of a convertible loan to be converted at the next qualified round. The convertible loan will have a maturity of 18 months, interest rates of 8% (8% fixed interest, accruing and capitalised at pre-payment or upon conversion) and standard discount rates depending on the length of its maturity (20% discount for 18 months maturity).

- If the convertible instrument matures after 18 months and the beneficiary has not scaled up, then further actions can be discussed with the EIC Fund.

The second tranche will be considered as the equity round. The remaining estimated investment will be fulfilled by private co-investors of an amount fully matching the totality of the EIC Fund investment, including the convertible loan provided by the EIC Fund in the first tranche. These private investors need to be vetted by the EIC Fund Board. Also, the EIC Fund Investment Committee will decide on the minimum size of the round, for the EIC Fund to invest in this tranche, based on due-diligence and the EIB's recommendation (the EIB is the EIC Fund's investment adviser).

After this, beneficiaries will begin a qualified or an unqualified round depending on whether a convertible instrument was used or not:

Resources

At Winnovart, it is part of our mission to bridge the gap between stakeholders of the grants-funding market-space across Europe. We believe in the potential of grants to create ecosystems that drive innovation, growth and reduce disparities between the regions of Europe. Our aim is to support innovative SMEs, private investors and funding agencies to become part of this ecosystem and make the most of it.

Our presence in Western, Eastern and Northern Europe enables us to create international business cases for our clients, in the context of attractive funding programmes as well as beyond it, by opening up international development opportunities.

For more updates on funding opportunities, please follow us on social media: Facebook, Linkedin or Twitter.

|

For more details about Winnovart please check our website. If you would like to be contacted by our experts please reply to

office@winnovart.com or contact us here and we will get in touch very soon.

|