.png)

The EIC Fund Investment Gap

Introduction

What is the EIC Fund?

The European Innovation Council (EIC) Fund is the investment vehicle of the EIC Accelerator programme - the European Commission's flagship innovation funding programme. With a budget of €3 billion from 2021-2027, the EIC Fund is positioned to be one of Europe's largest deep-tech venture capitalists (VCs) during this period. Through the structure of the fund, a minimum of €3 billion of private funds will be invested alongside the EIC Fund during this period. The EIC aspires to crowd in a further €30bn-€50bn as one of its six strategic goals.

The EIC Fund is a venture capital fund owned by the European Commission (EC) established to make direct equity investments in companies with breakthrough technologies. The Fund usually targets minority ownership stakes (10 to 20%). Furthermore, it participates in direct equity investment ranging between €0.5 million to €15 million in innovative companies that pass the rigorous EIC Accelerator selection process. The Fund invests on a matching (1:1) basis alongside a syndicate of lead investors from the private market.

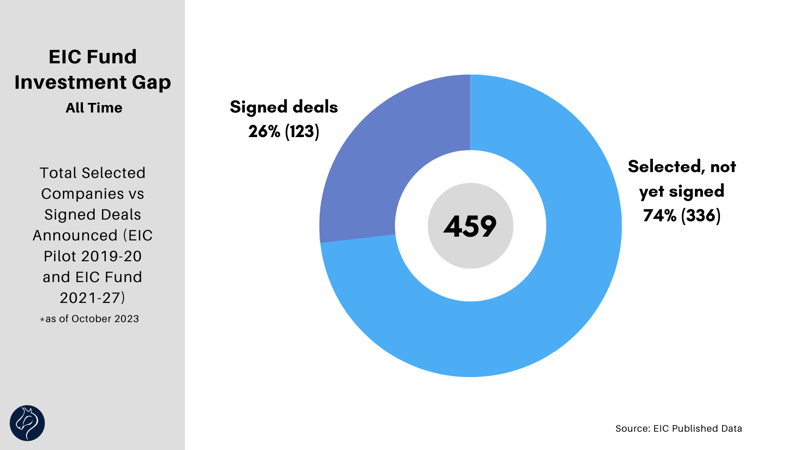

EIC Fund Investment Gap: Selected Companies vs Signed Deals

The investment gap refers to the difference between the number of companies selected for equity investment by the EIC Fund and the number of companies that have signed a deal. There is limited public information on the number of companies that have signed a deal with the EIC Fund under Horizon Europe. This data is available for companies that signed deals during the pilot phase during 2019-20. Yet only 36.3% of the signed deals during the pilot phase have been made public. Although there are multiple reasons behind this gap, our survey results may provide insight into some of the reasons. The following section provides further insight into this investment gap.

Evidence for the EIC Investment Gap

Start-ups and SMEs selected for equity investment have faced waiting times of over one year. The lack of funds has put many companies at risk of closure (source: Sifted.eu). The EIC Fund has faced many criticisms for its bureaucratic operations and slow investment process.

EIC Published Data

The EIC Fund investment gap at a glance

Since the creation of the EIC Fund during the EIC Pilot Phase, 459 companies have been selected for equity investment in the form of blended or equity-only funding. However, only 123 of these companies have managed to sign a deal with the EIC Fund. The EIC Fund investment gap is represented by the 336 companies which are yet to sign a deal and receive investment. This represents a remarkable 74% of companies selected to receive funding.

However, this gap could also represent a great investment opportunity for private investors: an opportunity to invest in innovative, science-backed companies with breakthrough technologies.

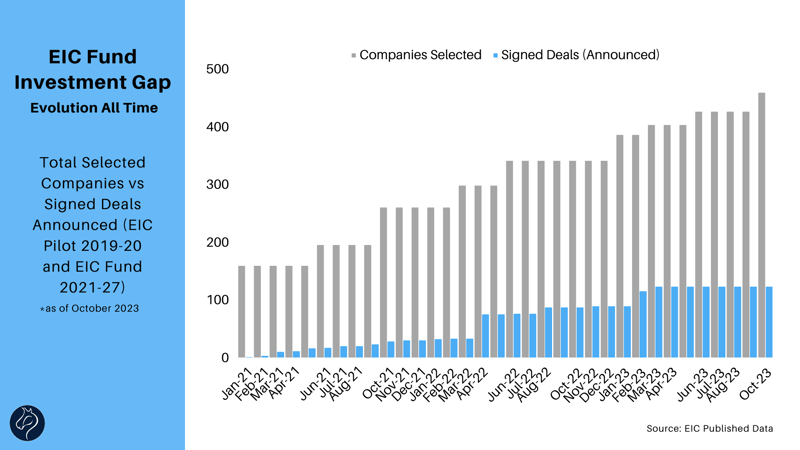

The evolution of the EIC Fund investment gap

The chart above illustrates the evolution of the investment gap (the difference between the grey bars and blue bars) across 2021, 2022 and 2023. The number of signed deals with the EIC Fund increased during this period, but the investment gap remains large. The EIC Fund has faced criticism for its slow and complex investment process. This has led to the appointment of Alter Domus as the EIC Fund's new external fund manager, which will hopefully speed up the investment process and lead to the completion of investments.

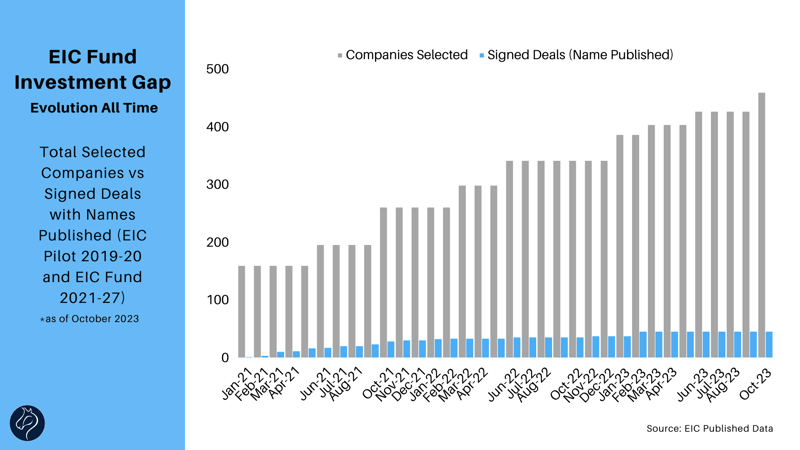

The EIC Fund investment gap is further magnified when looking at the number of companies selected for investment versus the number of signed deals where the names of the companies have been published (along with other information).

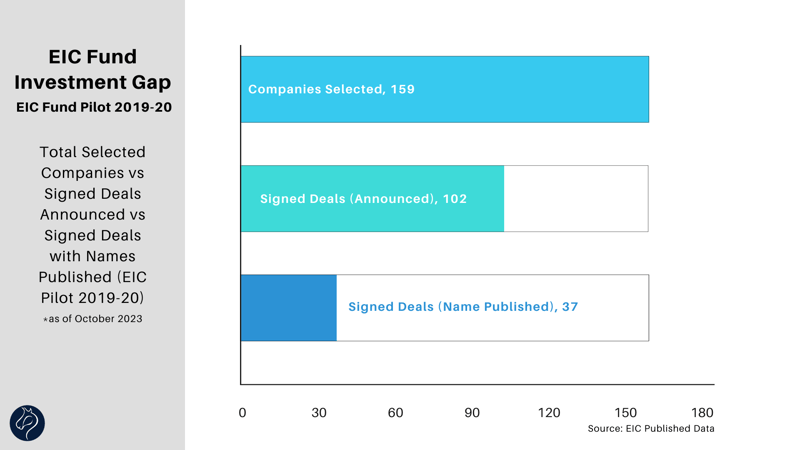

The current status of the EIC Fund investment gap

87.4% (139) of the companies selected for EIC Fund investment during the pilot phase are approved for investment. There have only been 102 signed deals. Companies are still waiting to receive their money. It should be noted that the last cut-off for the EIC Accelerator Pilot was in October 2020 - over 2 years ago.

.png?width=800&height=450&name=Bar%20Chart%20(2).png)

Since the introduction of the EIC Fund under Horizon Europe, only twenty companies have received equity investment. During this period, there have been 8 cut-offs for applicants, and 300 companies have been selected for equity only or blended finance. Given that there have only been twenty signed deals, the EIC has a clear backlog of deals that need to be finalised.

.png?width=800&height=450&name=Bar%20Chart%20(3).png)

Our Independent Data (Surveys, Statistics)

At Winnovart, we are currently researching the impact of blended funding programmes on the European innovation & investment ecosystem. We believe that blended funding (mixing grants & equity investments) is the most interesting development in the European grants-funding ecosystem for many years, promising to reshape its future.

We are looking to find out the general experience of selected companies and their private/lead investors with the EIC Fund. This will help us understand the reasons for the programme's current status, as well as the significant gap between the number of companies selected and the number of signed deals.

EIC Fund beneficiaries' experiences with the EIC Fund

Initial experience with the EIC Fund: 55% of respondents only faced a few obstacles, reporting a positive experience with the EIC Fund. 40%, on the other hand, faced many obstacles during their process with the EIC Fund however, out of that 40%, 5% believed that this caused a negative impact on their company.

Key challenges that our survey respondents faced: 75% reported that the key challenge they faced was the duration of the entire Fund investment process. Interestingly, 95% of respondents found that the EIC Fund lacked communication, support and transparency.

Click here to see the full results.

Private investors' experiences with the EIC Fund

Key challenges for Private Investors when engaging with the EIC Fund's blended finance programme: A clear cause of concern for 33% of private investors is the duration of the investment process. Furthermore, 25% of respondents believe that the complexity of the due diligence process is a challenge.

Interest in getting involved/continuing involvement with the EIC Fund: 20% of respondents expressed interest in getting involved/continuing involvement with the EIC Fund. 40% of respondents expressed interest in engaging with the EIC Fund so long as it suits their investment thesis (e.g., geography, size etc.). Lastly, 40% reported that they are not interested in engaging with the EIC Fund due to its complex and time-consuming nature.

Click here to see the full results.

Media commentary on the EIC Fund

A summary of the media's coverage on the EIC Fund can be found here.

Resources

- EIC Homepage: https://eic.ec.europa.eu/index_en?pg=investing

- EIC Fund: https://eic.ec.europa.eu/investment-opportunities_en

- EIC Work Programme factsheet: https://eic.ec.europa.eu/eic-work-programme-2022_en#factsheets

- Introduction to the EIC Fund: https://www.ncbj.gov.pl/sites/default/files/eic-fund.pdf

- EIC Accelerator: https://eic.ec.europa.eu/eic-funding-opportunities/eic-accelerator_en

- Sifted: Inside the EU’s stalling startup investment scheme: https://sifted.eu/articles/rise-fall-eu-vc-eic/

- Sifted: EU deeptech fund speeds up investments but many startups still left waiting for funding: https://sifted.eu/articles/eu-fund-startups-left-waiting-for-funding/

At Winnovart, it is part of our mission to bridge the gap between stakeholders of the grants-funding market-space across Europe. We believe in the potential of grants to create ecosystems that drive innovation, growth and reduce disparities between the regions of Europe. Our aim is to support innovative SMEs, private investors and funding agencies to become part of this ecosystem and make the most of it.

Our presence in Western, Eastern and Northern Europe enables us to create international business cases for our clients, in the context of attractive funding programmes as well as beyond it, by opening up international development opportunities.

For more updates on funding opportunities, please follow us on social media: Facebook, Linkedin or Twitter.

|

For more details about Winnovart please check our website. If you would like to be contacted by our experts please reply to

office@winnovart.com or contact us here and we will get in touch very soon.

|