€15 million in the form of grants, equity investments or blended finance were awarded to Greek firms between 2014-2022. 33 Greek firms succeeded in applying for funding from Europe's flagship EIC Accelerator programme (previously called SME instrument under Horizon 2020).

The EIC Accelerator programme helps high-risk, innovative SMEs and start-ups willing to develop and commercialise new products, business models, and services. These developments could potentially drive economic growth and influence new markets or disrupt existing European or global markets. The EIC Accelerator programme opens funding and investment opportunities worth over €1.13 billion.

Introduction to the EIC Fund & EIC Accelerator

The European Innovation Council (EIC) Fund is the investment vehicle of the EIC Accelerator programme - the European Commission's (EC) flagship innovation funding programme. With a budget of €3 billion from 2021-2027, the EIC Fund is positioned to be one of the largest deep-tech venture capitalists (VCs) in Europe during this period. Through the structure of the fund, a minimum of €3 billion of private funds will be invested alongside the EIC Fund during this period. The EIC aspires to crowd in a further €30bn-€50bn as one of its six strategic goals.

The EIC Fund is a venture capital fund owned by the European Commission established to make direct equity investments in companies with breakthrough technologies. The Fund usually targets minority ownership stakes (from 10 to 20%). Furthermore, it participates in direct equity investment ranging between €0.5 million to €15 million in innovative companies that pass the rigorous EIC Accelerator selection process. The Fund invests on a matching (1:1) basis alongside a syndicate of lead investors from the private market.

EIC Funding Impact in Finland

Overview 2014-22

Between 2014-2022, 33 companies have been successful in applying for funding from Europe's flagship EIC Accelerator programme (previously called SME instrument under Horizon 2020). €15 million have been awarded in the form of grants, equity investments or a combination of the two: blended finance.

*[Figures accurate as of 21/03/2023].

EIC SME Instrument & EIC Accelerator Pilot 2019-20 (Horizon 2020)

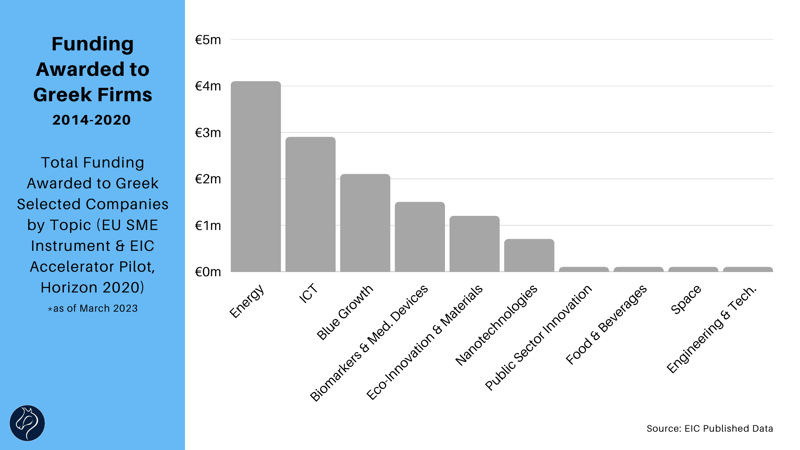

Overview 2014-20

Distribution of Funding

The top three topics that attracted the most funding were: (1) Energy €4 million, (2) ICT €3 million and, (3) Blue growth €2 million.

EIC Accelerator 2021-27 (Horizon Europe)

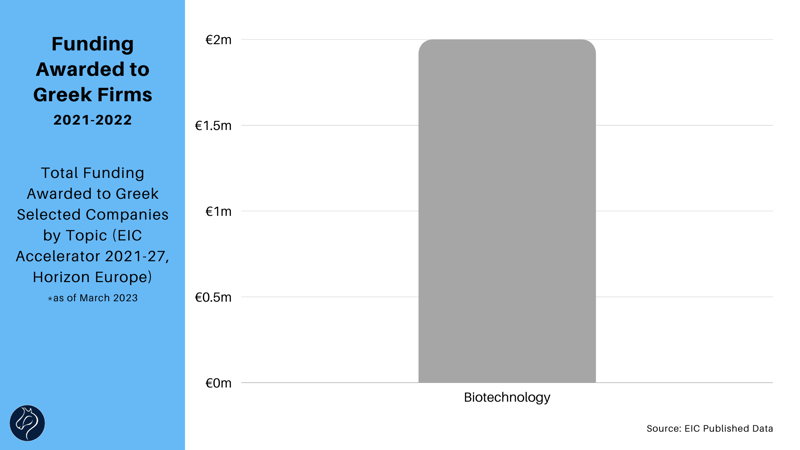

Overview 2021-22

Distribution of Funding

The topic that attracted the most funding was: (1) Biotechnology €2 million.

Greek Companies Selected by the EIC Accelerator

Notable Companies

Reach out for a full report with a detailed list of companies supported by the EIC programmes.

Current Investment Opportunities

Reach out for a full report with a detailed list of successful Irish companies seeking investment.

Investment Strategy

The EIC Fund's investment strategy:

- Early-stage equity investments (seed, start-up, scale-up).

- Equity investment between €0.5 million and €15 million.

- Possible follow-on investment.

- EU-wide investments across all types of technologies and verticals.

- Long time horizon (7-15 years).

- Minority ownership stakes between 10-20%.

How Winnovart Can Help You

If you need any support (tailored independent EIC Fund analysis & reports, finding a lead investor, discussing the experience of other selected companies and their lead investors, early access to companies selected by the EIC Fund/ deal flow), please reply to this email and/or reach out via the form below. We will be happy to discuss this further.

We aim to bridge the gap between the stakeholders in the EIC Fund ecosystem. More specifically, we want to support this ecosystem by sharing independent data, insights and statistics about this funding programme, as well as by facilitating and accelerating access to founders and/or private investors.

Resources

- EIC website: https://eic.ec.europa.eu/index_en

- EIC Fund: https://landing.winnovart.com/eic-fund-overview

- EIC Work Programme factsheet: https://eic.ec.europa.eu/eic-work-programme-2022_en#factsheets

- EIC Accelerator: https://landing.winnovart.com/eic-accelerator-overview-of-challenges-2023

At Winnovart, it is part of our mission to bridge the gap between stakeholders of the grants-funding market-space across Europe. We believe in the potential of grants to create ecosystems that drive innovation, and growth and reduce disparities between the regions of Europe. Our aim is to support innovative SMEs, private investors and funding agencies to become part of this ecosystem and make the most of it.

Our presence in Western, Eastern and Northern Europe enables us to create international business cases for our clients, in the context of attractive funding programmes as well as beyond it, by opening up international development opportunities.

For more updates on funding opportunities, please follow us on social media: Facebook, Linkedin or Twitter.

|

For more details about Winnovart please check our website. If you would like to be contacted by our experts please reply to

office@winnovart.com or contact us here and we will get in touch very soon.

|